This is a report on the state of Fibre and 4G deployment in Riyadh based on data points collected by Speedchecker in September 2018. The report discusses the state of Fibre and Mobile coverage (the extent of coverage and the quality of service) and the Speedchecker Measurement Method. The conclusion shows how Riyadh is placed to take advantage of future improvements to networks.

Current Network Coverage in Riyadh

Summary of Network Coverage

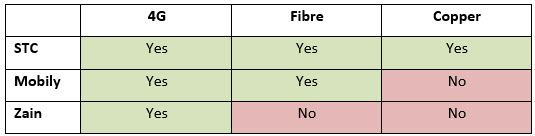

The three main Internet providers in Riyadh are STC, Mobily and Zain. Only STC provide services over 4G, Fibre AND Copper. Mobily offer 4G and Fibre and Zain provide 4G but not Fibre or Copper. Riyadh has excellent 4G coverage and Fibre is well established in the centre of the city and plans are well underway to extend the coverage to the main city areas. Fibre beyond the main city areas is planned but not currently in progress.

Fibre Coverage

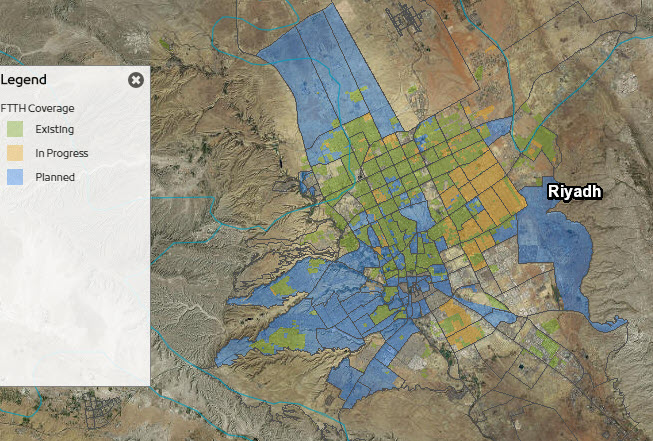

Fibre is widely available across Riyadh particularly in and close to the centre. The map shown below shows that coverage is poor in the South-West of the city and in the rural areas surrounding the city.

Fibre is provided by STC and Mobily with Mobily exclusively covering the South-West and ITC the North-East. Other existing areas are covered jointly by STC and Mobily.

The In Progress areas (yellow on the map) are either STC or ITC with some coverage being provided by Dawiyat.

Zain has no fibre coverage in Riyadh as at October 2018.

Fibre To The Home (FTTH) Coverage in Riyadh (January 2018)

Source: MCIT (https://www.mcit.gov.sa/en/wbsira-map)

4G Coverage

Riyadh has excellent 4G coverage with 4G being available in all urban districts and along the length of the main roads going into and out of the city.

Speedchecker Measurement Method

Speedchecker uses the billions of data points collected through its passive and active measurement technologies worldwide to provide insights to our customers. This is used by businesses to improve their service and by research establishments to provide invaluable information.

Each data point consists of many KPIs including speed, latency, location, connection type, device info. Our results focus on speed and latency as experienced on the device to provide insightful information on Quality of Service. More detail about the Speedchecker Measurement Method.

This data is then integrated into our customizable map-based dashboards for geospatial analysis.

STC Fibre Coverage

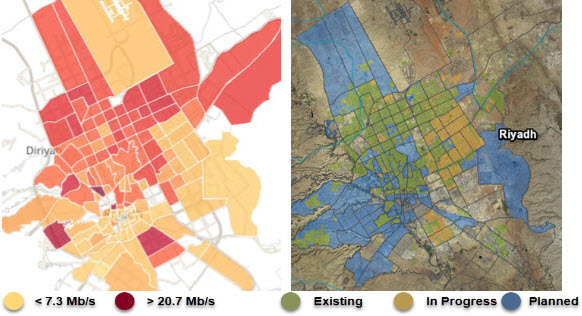

Riyadh has an ongoing plan to implement fibre broadband across the city. Our results clearly show a correlation between the speeds achieved in districts that have fibre and those that do not.

We analysed the fibre results from STC to see if they correlated with the rollout of fibre across Riyadh. Our results on the left show high-speed results in Red / dark orange and slower results in yellow / light orange. These can be compared with the green areas from the MICT rollout plan where fibre is already available and the yellow areas where it is in process. The blue areas show areas that are planned but not yet in process and it is in these areas that the speeds are low.

We are still analysing the results from Mobily fibre and will publish when the analysis is complete.

State of Riyadh Mobile Networks

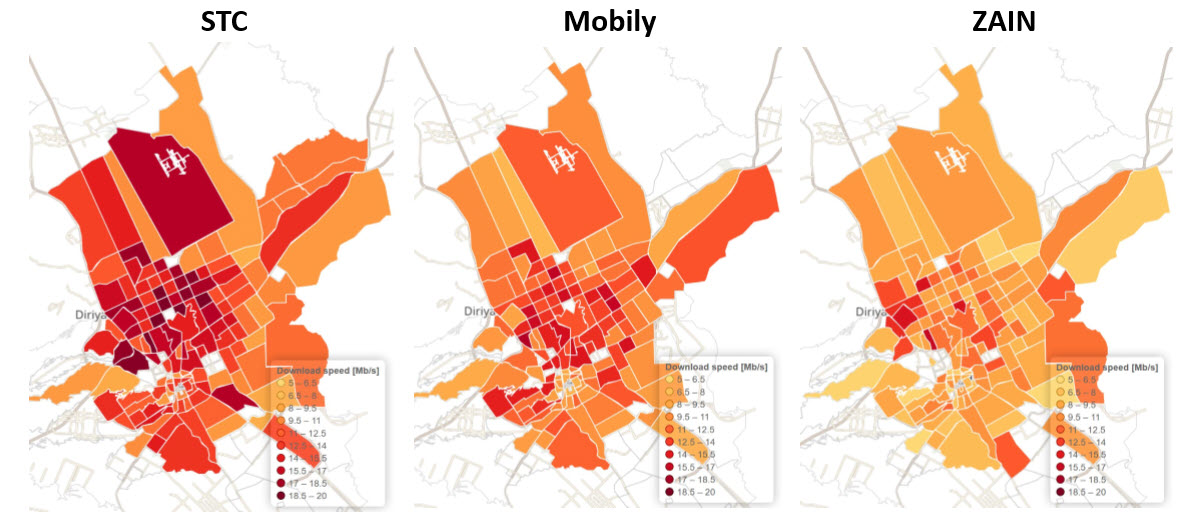

Speed result data points collected from Riyadh in September 2018 were analysed and allowed the top 3 mobile providers to be compared.

By adding the download speed data to our districts map of Riyadh we can clearly see that STC provided the fastest download speeds followed by Mobily and finally Zain. The maps also show a consistent difference in speeds from district to district. Districts that are the fastest or slowest for one provider tend to be the fastest or slowest for the others even though their actual speeds may vary.

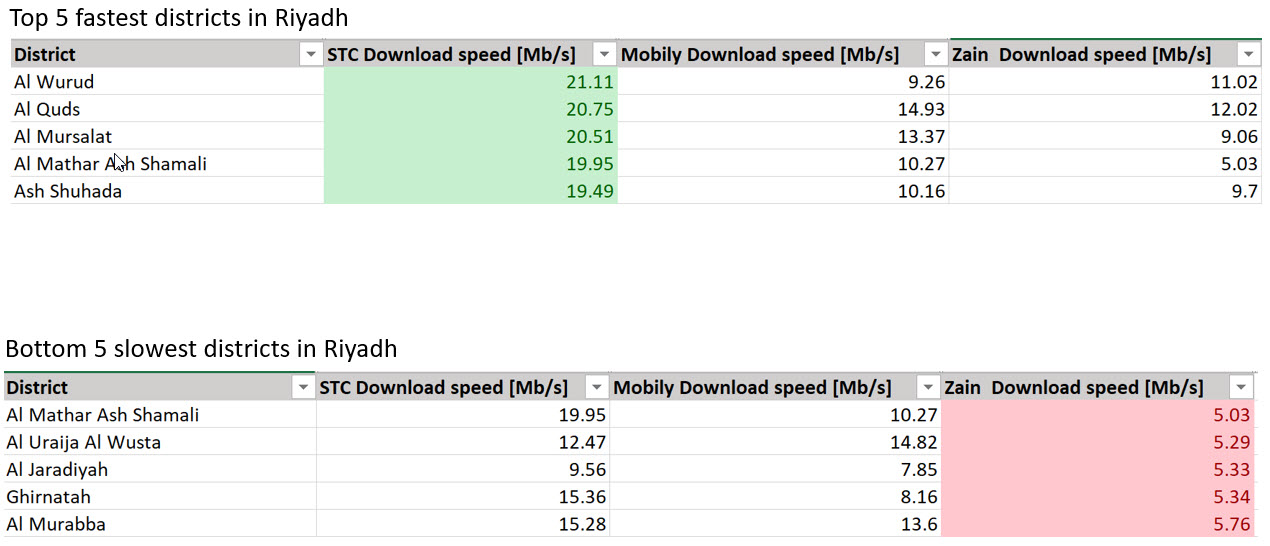

The following table illustrates the fastest and slowest districts in Riyadh based on the average mobile download speeds. The speeds highlighted in green represent the 5 fastest speeds by provider and the red speeds are the 5 slowest by provider. It is clear from this table and the maps above that STC are getting the fastest mobile speed test results and Zain the slowest.

Conclusion

Riyadh has excellent 4G coverage provided by STC, Mobily, Zain and other mobile operators. The MCIT (Ministry of Communications and Information Technology) plan for rolling out fibre across Riyadh is well-established and their progress map is accurate.

All 3 companies are providing a good service with STC having more coverage and faster speeds. Our report has highlighted some areas of Riyadh that could need some improvement in service and others that are doing very well. This may inform future plans for infrastructure changes.

This is a good foundation that should ensure Riyadh will be well-placed to continue to take advantage of improvements in technology such as 5G. This will ensure that businesses and residential users can continue to enjoy all the benefits that these advances bring.

Interested in more detailed information on the Internet quality and coverage in Middle East and beyond?

Interested in more detailed information on the Internet quality and coverage in Middle East and beyond?